Foxconn, Invests in Sharp to Strengthen its Position

Despite its recent financial struggles, Sharp remains one of the world’s most innovative display makers and still holds an intellectual property advantage in advanced liquid crystal display (LCD) technologies, particularly for high-resolution low temperature polysilicon (LTPS) smartphone displays, low-power oxide LCD panels and extra-large TV panels.

Hon Hai (Foxconn) is the largest systems integrator and subcontract manufacturer in the world, as well as a key component supplier for many other brands. Furthermore, Hon Hai’s scope has expanded from being an original equipment manufacturer (OEM) to creating its own brands, like InFocus, and offering component manufacturing and smart system integration for smart homes, robotics, the internet of things (IoT) and smart cars.

Hon Hai has been shaping its display business for years. Innolux, one of the largest thin film transistor (TFT) LCD manufacturers, also belongs to the Hon Hai group. Currently, the company owns half of Sharp’s Gen 10 TFT LCD, which is dedicated to large-size LCD TV panel production. If Hon Hai is able to gain control of Sharp’s Gen 10, it will have well-armed capacity for LCD TV, notebook, tablet PC, monitor and automotive displays. This vertical integration would allow Hon Hai to win key projects from customers like Apple, Sony, Vizio, Xiaomi and Huawei.

Hon Hai currently has three Gen 6 LTPS TFT LCD fabs under construction in Kaohsiung, Taiwan, and Guizhou and Zhengzhou, China. These investments total over US$10 billion and may also extend to OLED. However, Hon Hai needs to acquire more advanced technology and engineering resources to support its ramp up. With Sharp as the leading LTPS and oxide maker, a takeover would provide Hon Hai with the advanced display technology it needs for these three fabs.

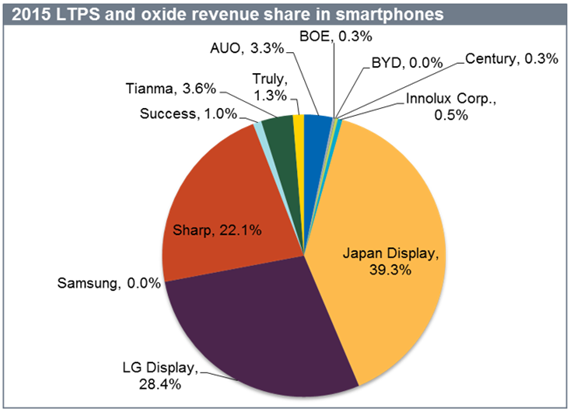

Sharp controls 22% of global LTPS and oxide LCD display shipment revenue for smartphones, which would strengthen Hon Hai’s stance considerably in mobile phone displays. Through its GIS subsidiary, which is a leading touch panel supplier and systems integrator for mobile products, the Hon Hai group has been aggressively expanding into touch panel technology and assembly integration. Sharp also owns many leading touch panel technologies and capabilities, so the business synergy in this area would be strong.

Sharp’s position in LCD TV, home appliances (especially in Japan), solar energy, business solutions, LED and electronic components would also provide Hon Hai with the know-how, capability and technology needed to strengthen its systems integration and manufacturing business lines.

Sharp’s LCD panel capacity and capability coupled with its successful history in electronic components and devices are important to Hon Hai. These would aid the company’s vertical integration efforts. Compared to Pegatron, TPV, Qisda and other electronics manufacturing service (EMS) competitors, Hon Hai would be able to offer complete solutions, including key components.

As one of the oldest electronics enterprises in Japan, Sharp possess a wide range of patents. Some of the patents are critical to the industry, such as multi-domain vertical alignment (MVA) wide view angle technology and many oxide (IGZO) processes. The patents are not only display related, but also include technology used in consumer electronics, solar, industrial engineering, light-emitting diode (LED), semiconductor and medical solutions.

Hon Hai has clearly defined its strategy for systems integration and EMS without the possession or license of brands. However, Hon Hai has to rely on these capabilities and its superior supply chain management to win orders from leading global brands.

The LCD TV is the most important consumer electronics device for Sharp and also licenses its brand to Hisense and Best Buy in North America and UMC in Europe.

Sharp’s branded products also include smartphones, notebooks, medical devices, tablets, interactive white boards, public displays, digital multi-functional printers, desktop monitors, air cleaners and solar systems, all of which interest Hon Hai.

A takeover of Sharp would mean more cooperation between Sharp’s branded business and Hon Hai’s EMS manufacturing. One possible scenario would be for Hon Hai to focus on manufacturing and supply chain management while Sharp focuses on panel manufacturing and brand marketing.